The most important function of Overview is to show how people are moving in different urban outdoor areas, and how well OOH advertising is reaching people. Using different databases, we have assembled weekly statistics from traffic as well as shopping environments. In this article, we open up these numbers and head our view to future events and themes.

The Easter weekend was full of sunny and warm spring days. There were a lot of both, air travelers as well as cruise ship travelers, last week. The predictions for summer traveling are very promising. Already people are booking holiday trips to warm destinations, and people are investing in the planning of summer holidays.

Spring is full of celebrations, and next the view is head to May Day (vappu) and mothers day. This year May Day is on weekend.

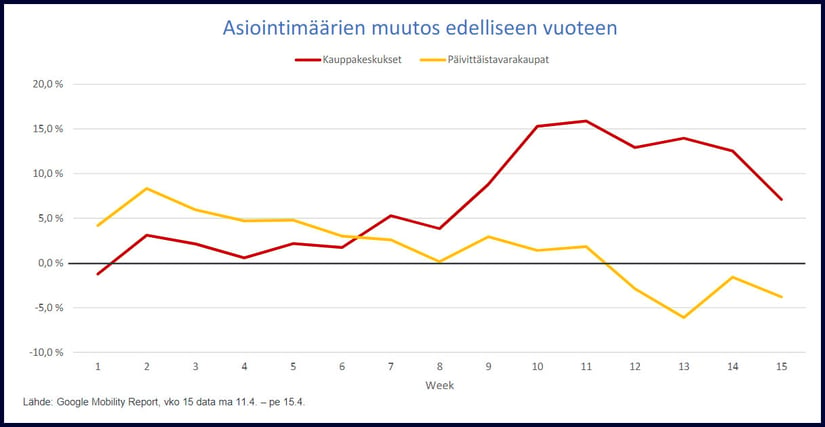

Chances in week 15 compared to last year's numbers:

- Visitors in shopping centers +7 %

- Visitors in grocery stores & pharmacies -4 %

- Public transport +7 %

- People’s mobility in their residential areas +2 %

- Mobility at outdoor recreation areas -4 %

Grocery stores and shopping centers

On Easter week there was some decrease in the number of visitors to grocery stores and shopping centers, as expected. People were spending their time with family and outside. Nevertheless, there were more visitors in shopping centers than last year, and visitors in grocery stores were almost the same numbers.

In week 15 the number of visitors in shopping centers has risen +7 %, and in grocery stores decreased by -4 %, compared to the year 2021.

When compared the whole March of 2022 to March 2021, the number of visitors in shopping centers has risen +13 % and in grocery stores fell -0,4 %.

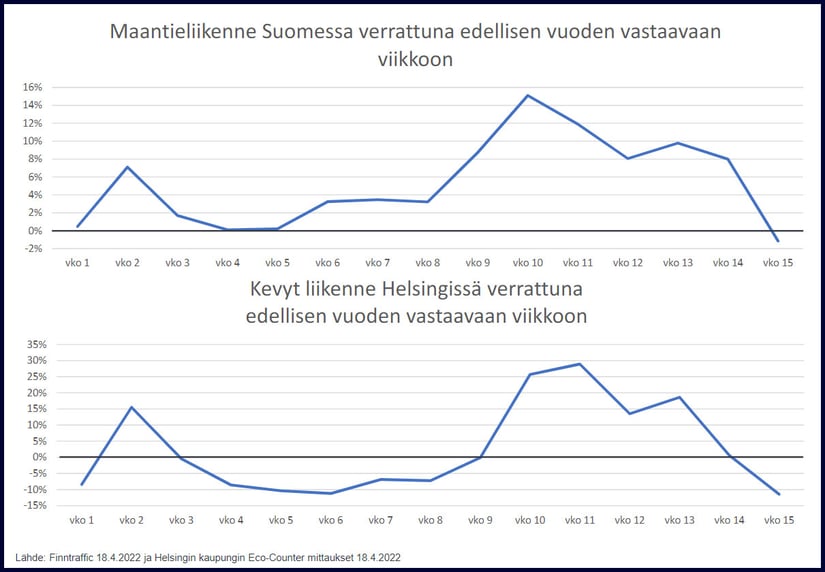

Road traffic changes

The silence of traffic is common during Easter week and, for example, on Good Friday traffic is about one-fourth less than on a normal Friday. Also, light traffic was affected by Easter.

HSL tells how city bike season has started, even though the circumstances have been challenging. Most of the city bike stations are in use now, but some stations are still under construction. There has been made already been over 36 000 bike trips in Helsinki and Espoo.

In week 15 traffic has declined -1 %, and light traffic -11 %, compared to the year 2021.

When compared the whole March of 2022 to March 2021, road traffic has risen +10 % and light traffic has set +17 %.

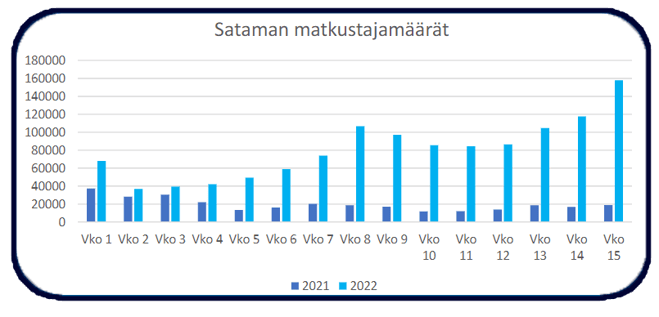

Port of Helsinki

Easter cruises were expectedly popular and the number of visitors to Port of Helsinki rise +34 % compared to last week. Spring has been very favorable to cruise traveling, and the view is even more propitious heading to summertime. Port of Helsinki tells on their website how to cruise traveling has recovered in Helsinki. From January to March there were over one million travelers in the Port of Helsinki. The growth percent is amazing at 171 % compared to the same time in the year 2021.

On week 15 there were 158 000 travelers in the Port of Helsinki.

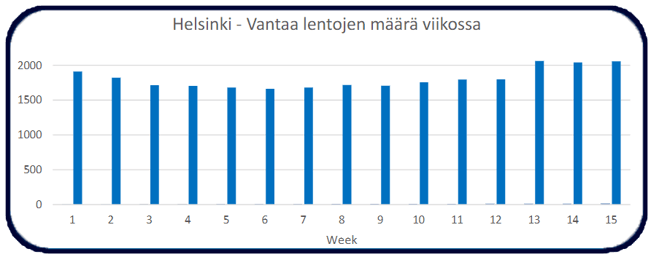

Airport

On week 15 there were 2 057 flights in Helsinki Airport, which is slightly more than last week. MTV news tells, how traveling has returned almost to the normal stage as before the pandemic. Summer season trips are sold now and cold spring has inspired people to book trips to warm destinations.

In March were 838 000 travelers in Helsinki airport, which is over 200 000 travelers more than in February.

Check out our solutions for outdoor advertising:

Did you have any questions? Contact our sales:

Ville Bergman

Sales Director

+358 207 312 043